Commercial vehicle sales in April reached 370,000 units, a 3% year-on-year increase. Maxus entered the top ten, while Sinotruk and Dongfeng are vying for the top two spots. Who will take the crown?

Apr 05,2025

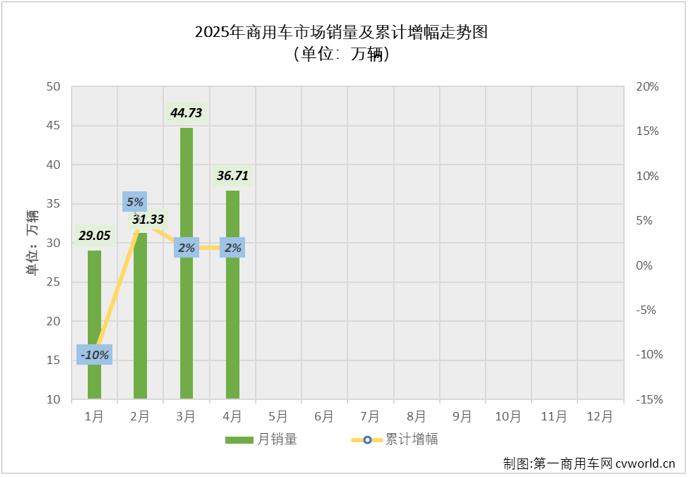

According to data from China Association of Automobile Manufacturers (CAAM) (based on invoiced vehicle numbers, not actual retail sales; the same applies below), in April 2025 China's commercial vehicle market sales reached 367,100 units, an 18% month-on-month decrease compared to March and a 3% year-on-year increase. The year-on-year growth rate turned positive (in March the commercial vehicle market saw a 2% year-on-year decline).

According to data from China Association of Automobile Manufacturers (CAAM) (based on invoiced vehicle numbers, not actual retail sales; the same applies below), in April 2025 China's commercial vehicle market sales reached 367,100 units, an 18% month-on-month decrease compared to March and a 3% year-on-year increase. The year-on-year growth rate turned positive (in March the commercial vehicle market saw a 2% year-on-year decline).

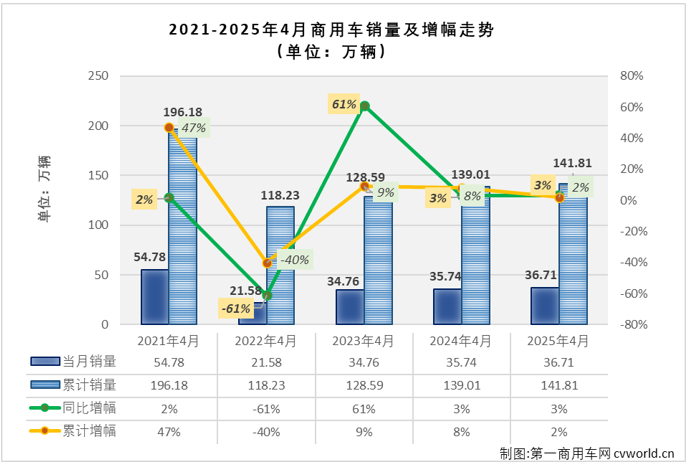

Observing the sales and growth trends of commercial vehicles in April over the past five years, we see a pattern of increase-decrease-increase-increase-increase. Four out of the last five Aprils have seen growth in the commercial vehicle market, in April 2021 sales exceeded 500,000 units, reaching 547,800 units. However, this was followed by a 61% year-on-year decrease in April 2022, dropping to the 200,000-unit level. In the last three Aprils, the commercial vehicle market sold 347,600, 357,400, and 367,100 units respectively—very close figures. The April 2025 sales of 367,100 units ranking second highest in the past five years is considered normal performance.

Foton maintains top spot with over 50,000 units, Dongfeng and Sinotruk compete for second place.

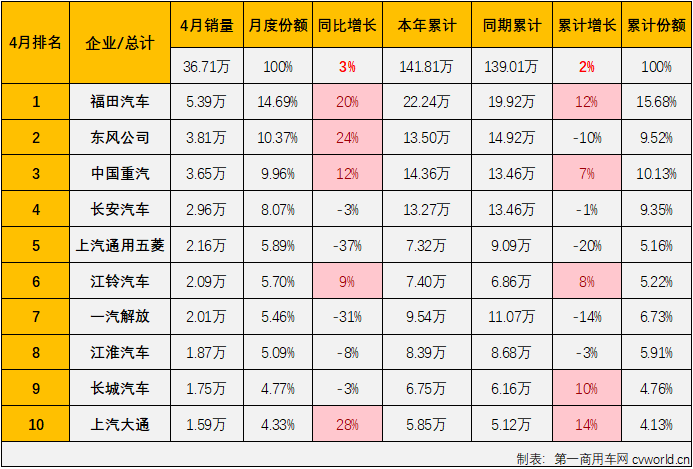

In April 2025, 11 companies in the commercial vehicle market sold over 10,000 units (Shaanxi Automobile, ranked 11th, also exceeded 10,000 units), same as March. Foton maintained its lead with 53,900 units, securing its 4th monthly championship this year in the commercial vehicle market.

April 2025 Commercial Vehicle Market Sales (Unit: Vehicles)

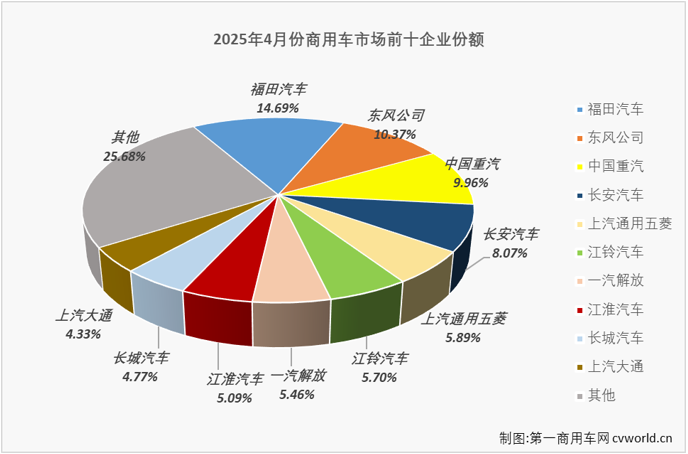

Above table shows that in April 2025, the commercial vehicle market saw a 3% year-on-year increase, turning positive from the previous month's -2%. While the overall market saw a small year-on-year increase, major companies experienced mixed results, five of the top ten companies showing increases (Foton, Dongfeng, Sinotruk, JMC, and Maxus saw year-on-year sales increases of 20%, 24%, 12%, 9%, and 28% respectively, the growth rates of these companies exceeded the overall market growth) and five showing decreases (two of them experienced drops exceeding 30%, the worst performer seeing a 37% year-on-year decrease in April sales).

In terms of industry structure, the top ten commercial vehicle sales rankings in April saw changes in both members and rankings: Maxus returned to the top ten, ranking 10th in April (Maxus was ranked 11th in March); Wuling rose three places to 5th (Wuling was ranked 8th in March); and Great Wall rose one place to 9th (Great Wall was ranked 10th in March). Conversely, more than one company saw a decline in ranking. The rankings of Foton, Dongfeng, Sinotruk, and Great Wall (ranks 1-4) and JMC (rank 6) remained consistent with March.

Previous:

Next:

Related News